Maybe You Don't Want Bonds' Home Run Ball

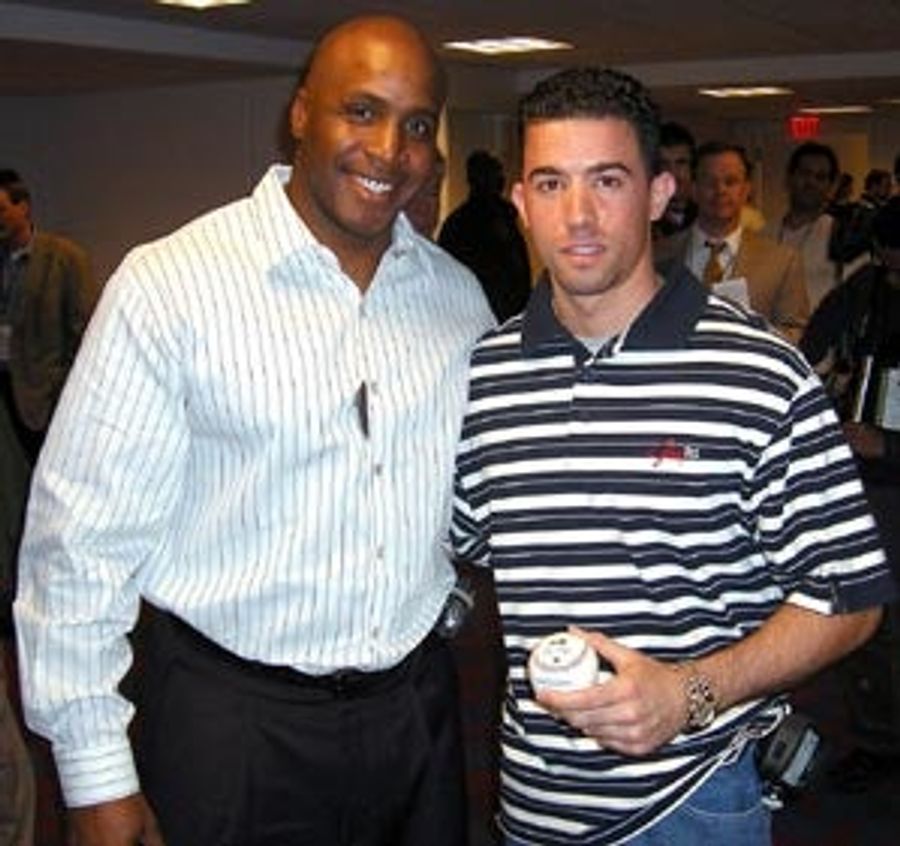

Imagine, hypothetically, that you were the one to catch Barry Bonds' 756th home run ball. It's not gonna be worth as much as it would have been a few years ago — you see, Barry Bonds has done a shitload of steroids, and many don't like that — but it still might, say, pay for a semester of college. (Public college. OK, we kid: It's expected to go for half a million.) Maybe you'd want to make a statement and throw it back. We'd applaud you for that ... but we'd be the only ones.

Anyway, over at one of the Wall Street Journal blogs, they're hypothisizing that you could be eligible to be taxed the minute you grabbed the ball.

It's taxable income to the fan the instant that person catches the ball because it's "accession to wealth." This view logically stems from cases saying that someone who finds a "treasure trove" owes tax on it right away.

That's extremely depressing. Tim Forneris, a nation turns its lonely eyes to you. You dope.

Tax Law Final Exam Question: Barry Bonds's Ball [WSJ Law Blog]

Related

Big Ten March Madness Contenders Ranked by Analytics

Three Eastern Conference Trade Deadline Winners to Watch

- NL Central 2026 Futures Picks: Brewers, Pirates and Cardinals Bets

- Thursday Feb. 26th NBA Best Bets: Top Basketball Betting Predictions Today

- Three Best College Basketball Bets For Feb. 25th's Slate

- Three Best NBA Bets for Tuesday Feb 24th's Slate

- NL East Future Betting Picks: Season Win Totals and Division Predictions

- Monday College Basketball Betting Picks for Houston-Kansas and Louisville-UNC

- Olympic Hockey Gold Medal Betting Picks: USA vs. Canada Predictions