MLB Confidential, Part 3: Texas Rangers

Our final document — at least for now — belongs to the Texas Rangers. Out of all the financial statements we've seen, it offers maybe the fullest picture of owning a team.

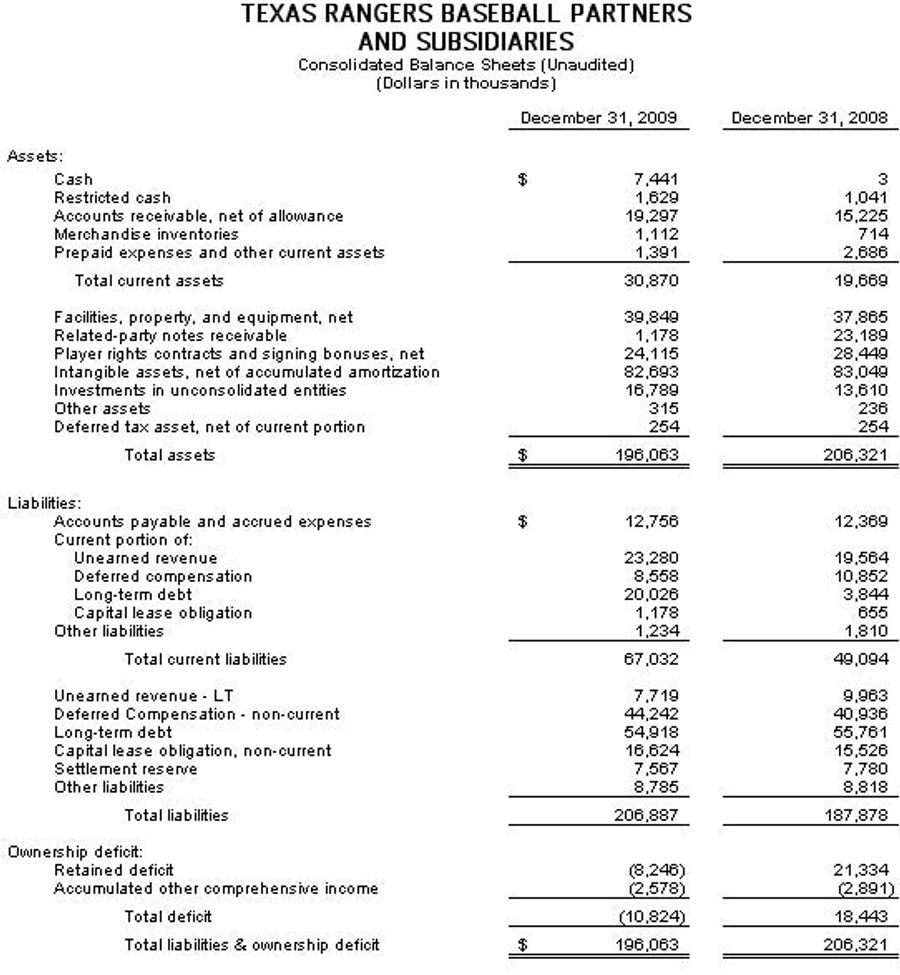

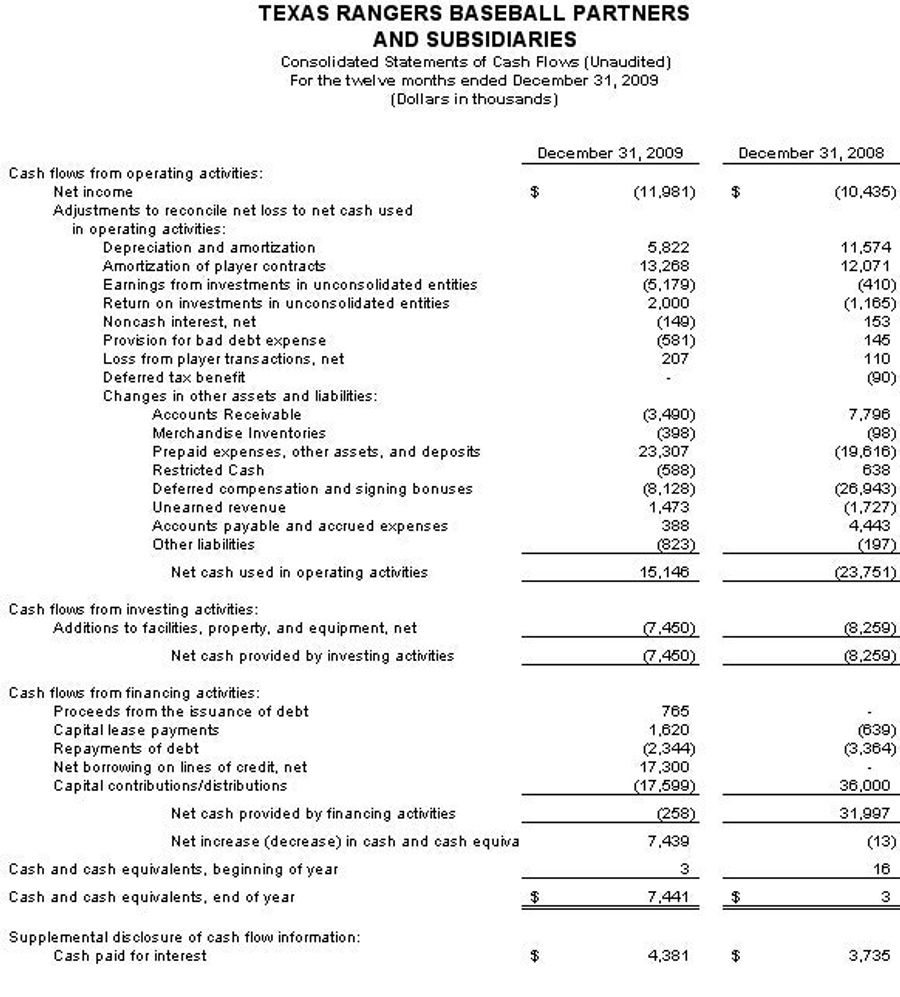

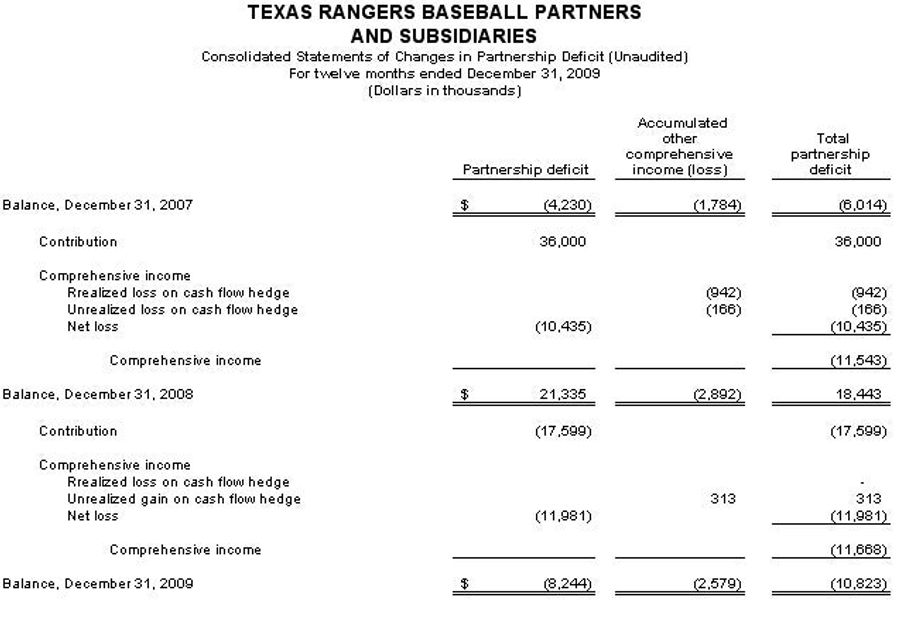

The Rangers' financials come via Excel spreadsheet, which you can download below. First, the basics (click to enlarge):

Both the "long-term debt" line item on the first page — $55 million in 2009 — and the $19 million that the partnership had to kick in that year (fourth page) indicate some of the troubles that would edge into public view in recent months.

Also of note: the massive broadcast revenue — outstripping even the Mariners, who have the Pacific Northwest all to themselves — and the net income loss, even though the Rangers netted $23 million and $5 million in revenue sharing in 2008 and 2009 (oddly, revenue sharing shows up in the Rangers' statement as a negative expense). That loss, as University of Michigan sports economist Rodney Fort points out, is largely an accounting fiction that vaporizes when you factor back in the amortization deductions for player contracts. The amortization is an old scheme whereby a baseball team at tax time treats its roster in roughly the same way your office might treat its Xerox machine, i.e. as a depreciating asset, even though a.) player costs are expensed already, and b.) an owner doesn't bear the cost of a player's depreciation; the player does. "It's not a real cost that is borne by the team," Fort says. "They never had to write a check. ... Technically, it's spendable money. You should add it back in."

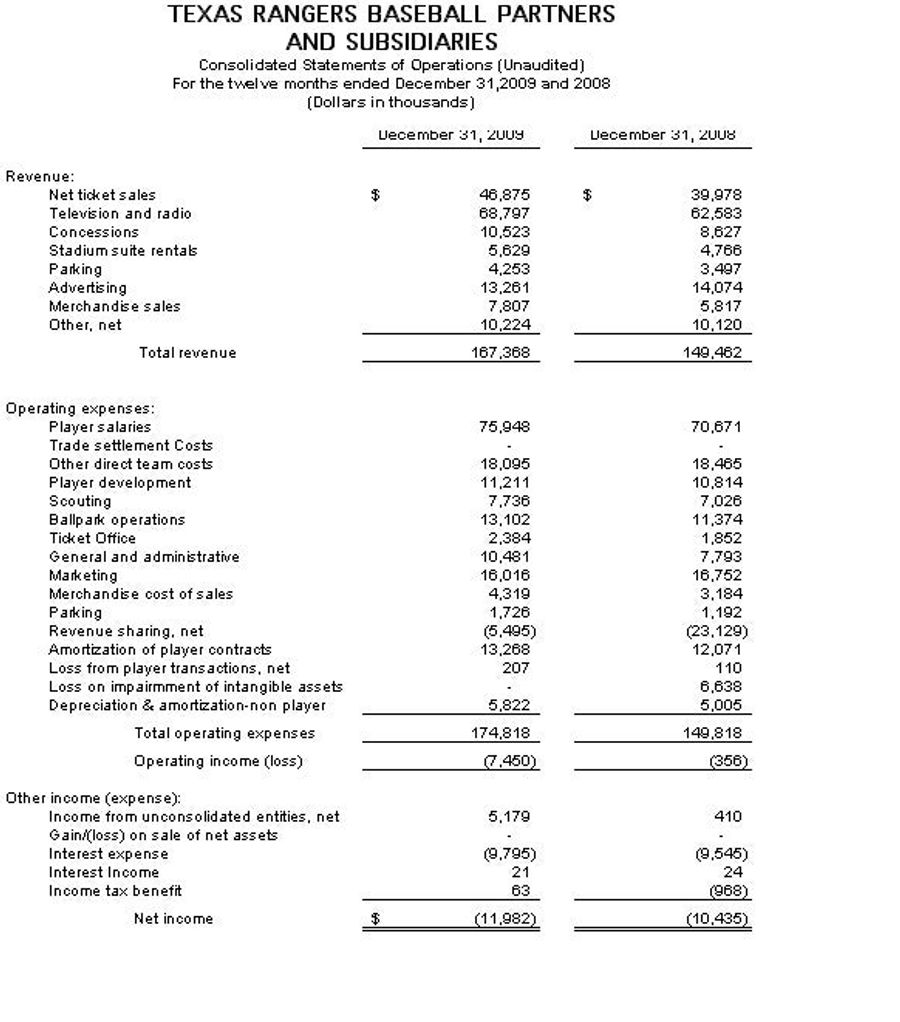

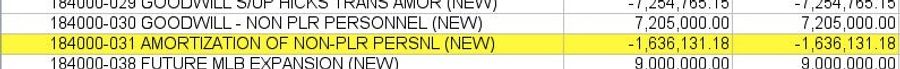

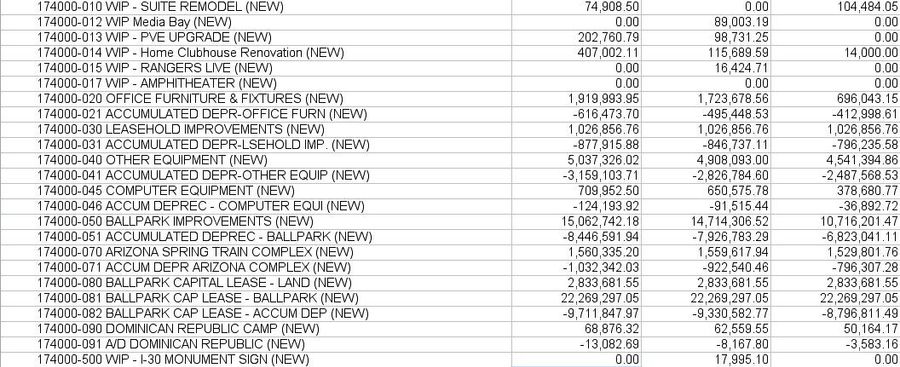

There's a lot more to the Rangers' statement than just that, however. The Excel file contains page after page of hidden cells that, with a small bit of safecracking, reveal in gloriously mundane detail the ins and outs of owning a baseball team. The formatting is a little screwy, and the numbers occasionally fall out of plumb, but you'll find a wealth of information from a number of seasons. For instance:

This suggests that the Rangers are treating not only players but managers, bench coaches, etc., as depreciating assets, further stretching the already-thin logic of the tax allowance. "If it extends to manager contracts, I wouldn't be surprised," Fort says. "Maybe owners' dogs can be thrown into this, too. It's a very, very strange allowance in the first place." It's smart accounting if it's not tax fraud.

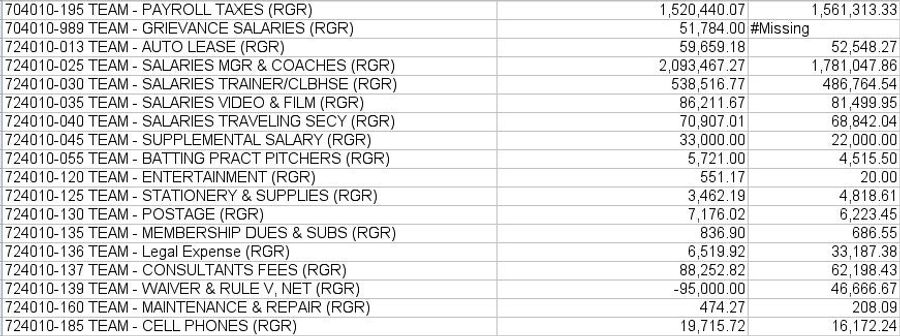

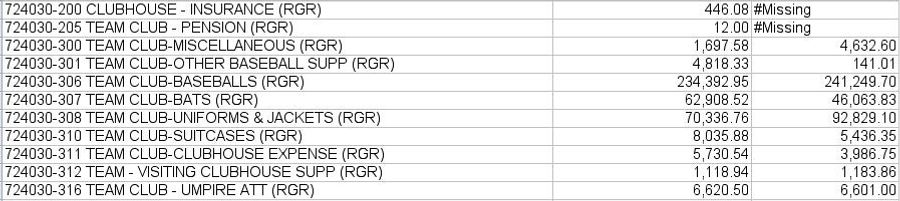

From the file, we also get detailed miscellany about running the Rangers ...

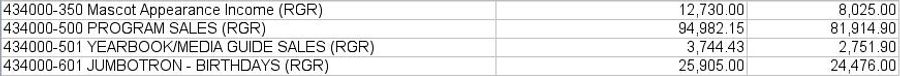

... down to how much the team makes off mascot appearances and (apparently) Jumbotron birthday announcements:

There's much more to unpack. Have a look for yourself. I'll update with any other significant findings.

Rangers financial statement, short version (.xls file) Rangers financial statement, extended version (.xls file)

(UPDATE: Maury Brown thinks the last document is a "scratch workbook," which explains all the errors and inconsistencies. Keep that in mind as you read.)

MLB CONFIDENTIAL: The Financial Documents Baseball Doesn't Want You To See Part 1: Pittsburgh Pirates, Tampa Bay Rays, Florida Marlins, Los Angeles Angels of Aneheim Part 2: Seattle Mariners Part 3: Texas Rangers

Related

What Bruce Meyer’s Promotion Means for the 2027 MLB Lockout

Three MLB Futures Picks to Beat Los Angeles Dodgers in 2026

Why the NBA's New Anti-Tanking Ideas May Backfire

New England Patriots Have Major Needs After Super Bowl Loss

- Friday NBA Odds & Best Bets: Feb. 20th Top Basketball Betting Picks

- MLB AL West Future Betting Picks: Totals, Pennant Winner, and More

- College Basketball Thursday Picks: Feb 19th Best Betting Predictions

- Genesis Invitational Best Betting Picks: Scottie Scheffler Headlines Return to Riviera

- NBA Betting Picks for Thursday Feb. 19th’s Return From All-Star Break

- Best 2026 American League Central Season-Long Future Betting Predictions

- Tuesday Feb. 17th College Basketball Betting Picks and Predictions